Automatic mileage tracker

Never miss a mile with the Everlance mileage tracker app. Set it, forget it and track all your miles.

.webp)

The most convenient way to track mileage

%20(1).webp)

Try our app for free

%20(1).webp)

%20(1).webp)

Start tracking your mileage today

Sign up for freeGets the job done and then some! Simple design, lots of features...Read more

Gets the job done and then some! Simple design, lots of features. This is intuitive, easy to customize and the reports are detailed and easy to work with.

I have been using the premium version for 2 months without any glitches, dropped or missed trips. I now have confidence in my mileage logs, and it definitely pays for itself...Read less

Mary2820

Everything you need in a mileage tracking app

Tracking style flexibility

Choose to create a new trip for every stop or group all trips in a session into one

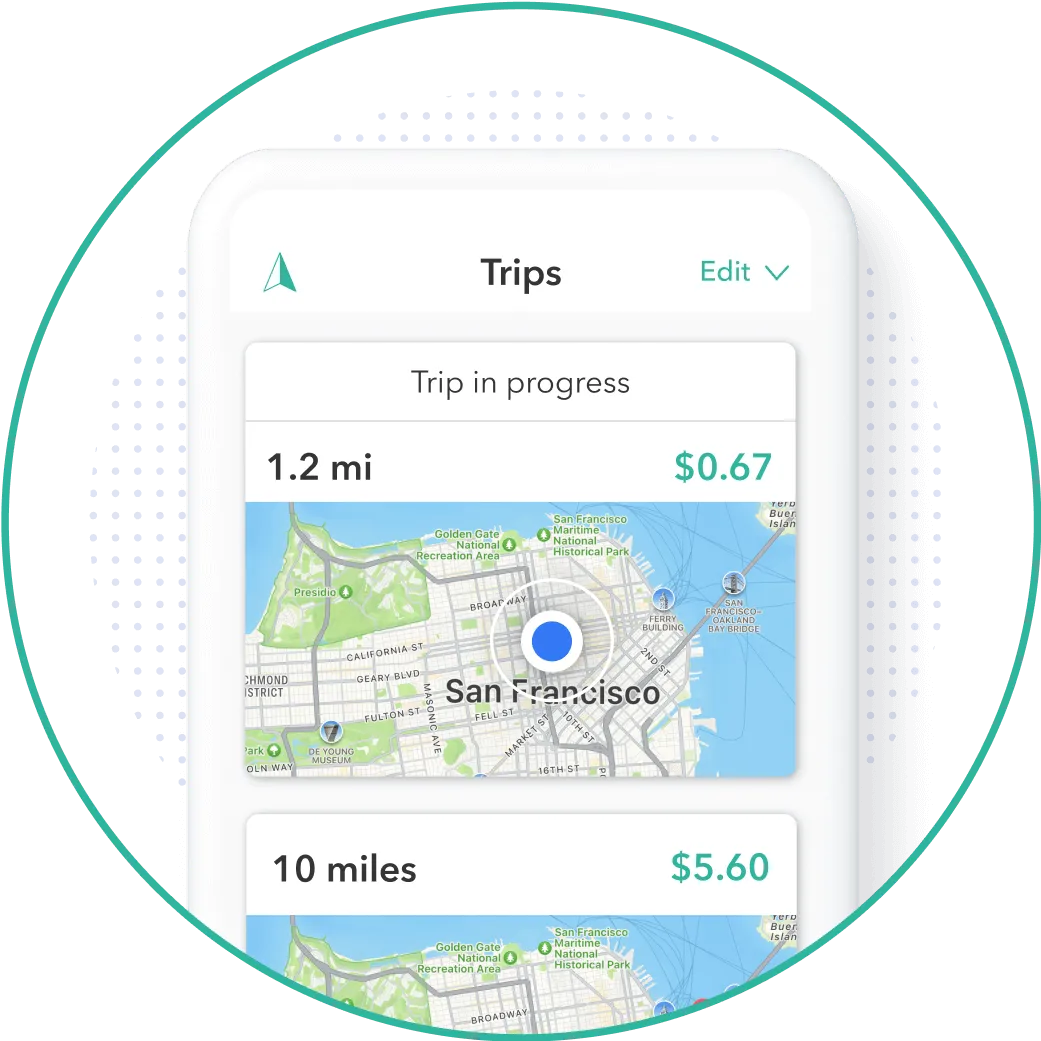

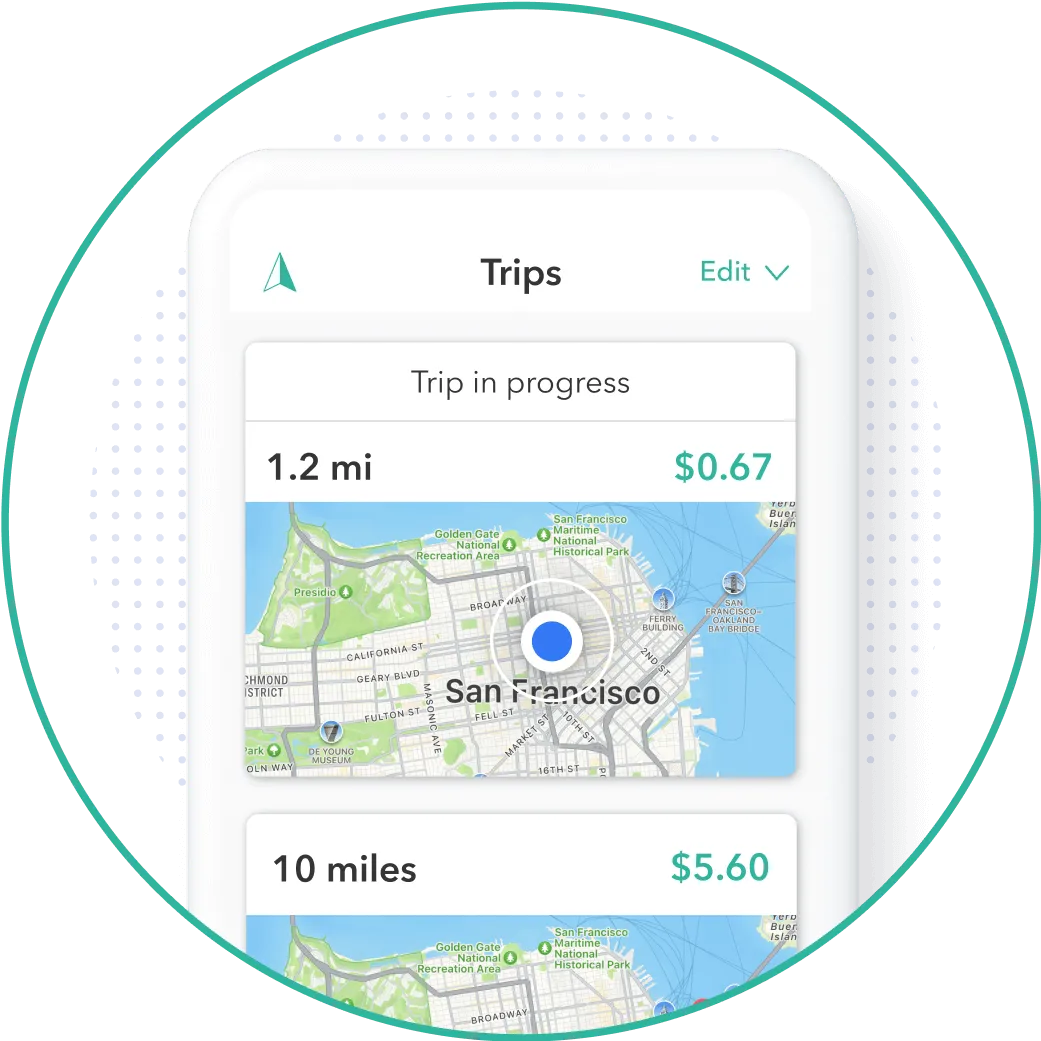

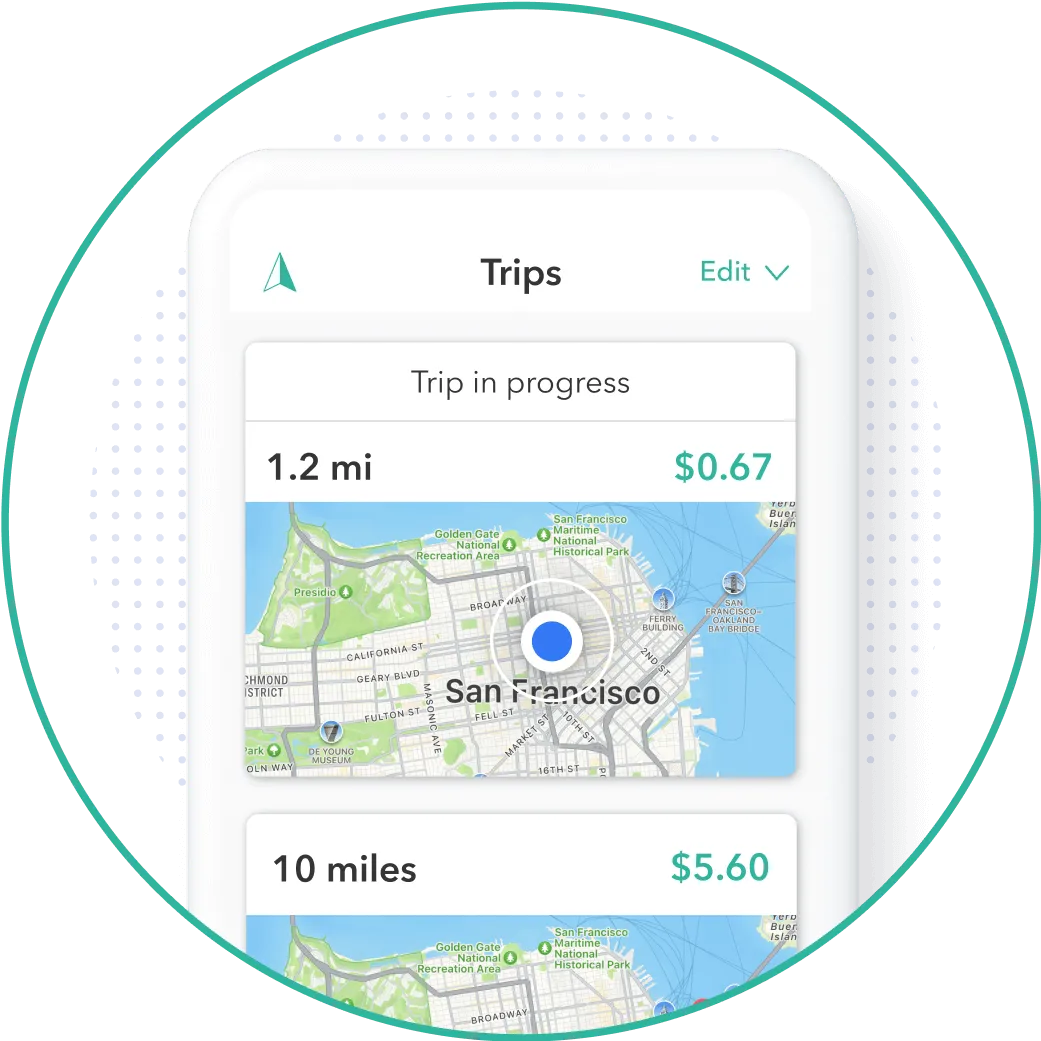

Visual route maps

See your entire trip route and starting & ending locations in an elegant map

Privacy

All your data is private to you and never sold or shared unless you decide to

Auto-classification

Automatically categorize trips you take during specific days and hours

Custom purposes and tags

Categorize and label your trips and mileage how you want to stay organized

Favorite place detection

Automatically identify the places you visit often and categorize common trips

One-swipe classification

Simply swipe left or right to categorize trips that haven’t been auto-classified

Unlimited data exports

Download IRS-compliant mileage logs in a few clicks, whenever you need

Expense tracking

Keep track of all your business expenses in the same easy-to-use app

Who uses the Everlance mileage tracking app

Company fleets

Track mileage for personal use and comply with IRS requirements

Easily determine fringe benefit

Reduce audit risk

Employees drive personal vehicles and get paid for mileage instead? Learn about our mileage reimbursement product here.

What some of our 3 million users are saying

Thank God I Found This App

Talk about a time saver. I used to spend 20 minutes a...Read more

Talk about a time saver. I used to spend 20 minutes a day as a realtor writing my mileage by hand and then tons of time figuring out the totals at the end of the year. For $60/year, all that headache is gone...Read less

Excellent experience so far

The swipe feature is great, and it saves your trips for...Read more

The swipe feature is great, and it saves your trips for when you forget to toggle it on. Very very good feature. I have a subscription to this service and I don't regret it one bit. This is one of the only apps I am currently paying for...Read less

Best app for DoorDash

This app is necessary for any kind of deliveries. It records...Read more

This app is necessary for any kind of deliveries. It records my miles and prepares me for a big tax break. If you are a delivery person, you need this...Read less

Friendly help when you need it

24/7 customer service

Expect a prompt response no matter the day or time

Expect a prompt...Read more

Expect a prompt response no matter the day or time...Read less

Email, phone and chat

Connect with a real person for mileage tracker app support (phone and chat available in Premium only)

Connect with a real...Read more

Connect with a real person for mileage tracker app support (phone and chat available in Premium only)...Read less

English, Spanish and French support

Get answers about mileage tracking in your language

Get answers about...Read more

Get answers about mileage tracking in your language...Read less

Track mileage how you want

%20(1).webp)

Why Everlance is the best way to track mileage

#1-rated

Everlance is the top mileage tracker app according to real user reviews

Quick and easy

Tracking mileage, classifying trips and downloading data is a breeze

Superior support

Get assistance from our customer support team via phone, chat or email

Everything you wanted to know about mileage tracking

Mileage tracking can be a tedious job, especially if done manually. But if you aren’t tracking your miles, things can turn into a dangerous guessing game that not only puts you at risk in the case of an IRS audit, but also costs you money every month.

Luckily, there are tools that can make this job easy, accurate and stress-free, no matter your industry or role.

So, we’re going to explore everything you need to know about mileage tracking. We’ll talk about different tools and apps, the benefits of mileage trackers, why they are important and how they can make your work life at least a little bit easier.

%201.svg)