Navigating taxes as a self-employed individual can be complex, but understanding your obligations and potential deductions can significantly streamline the process. This guide offers an in-depth look at managing your self-employed taxes efficiently, ensuring you meet your legal requirements while maximizing your returns.

Have specific questions? Jump to what you need:

How to Calculate Self-Employed Taxes

How to File Self-Employment Taxes

How to Pay Taxes When Self-Employed

Quarterly Taxes for Freelancers

How much should I set aside for taxes as a freelancer?

As a self-employed individual, you are responsible for paying taxes on your income. Unlike employees, taxes aren’t automatically taken out of your payments. Instead, you are responsible for setting aside money for your taxes and then paying the IRS.

What counts as being self-employed? You don’t have to have your own business to have some self-employed income. Types of work that counts as self-employed income includes:

Let’s dive into how to handle self employed taxes, step-by-step.

Even if it’s not tax season yet, you may be wondering how much you’re going to owe once tax season does come around.

One easy solution is to use an online tax calculator to easily estimate the amount of taxes you’ll owe.

However, once you’re filing your taxes, you need more than an estimate. Thankfully, one of the tax forms you’ll need (the Schedule SE form) will help you calculate the exact amount of taxes you owe based on your income and deductions.

Remember, as a self-employed worker, you’re eligible to write off business-related expenses. This is true whether you own your own business or just do Instacart as an independent contractor.

The goal with writing off expenses is to pay less in income taxes by deducting the cost of your business expenses from your gross income. Put another way, it makes any money you make that is invested back into your business tax-free.

Think of it this way:

[total gross income] - [business expenses] = [adjusted gross income]

You only have to pay taxes on your adjusted gross income (or AGI), so it’s worth it to take all the deductions you’re eligible for.

As a self-employed individual or independent contractor, you could be eligible for a number of tax write-offs, including for expenses like:

Of course, this isn’t a complete list! Check with a tax professional to see what’s relevant to your unique situation, or take a look at our ultimate list of tax deductions for self-employed workers.

This is the most involved step in the process, but we’ll break it down for you. Stick with us, okay?

To file taxes, first you need to gather the appropriate forms and documents. Here’s what you may need:

There may be additional state and local tax forms you’ll need as well—check with your tax service or professional.

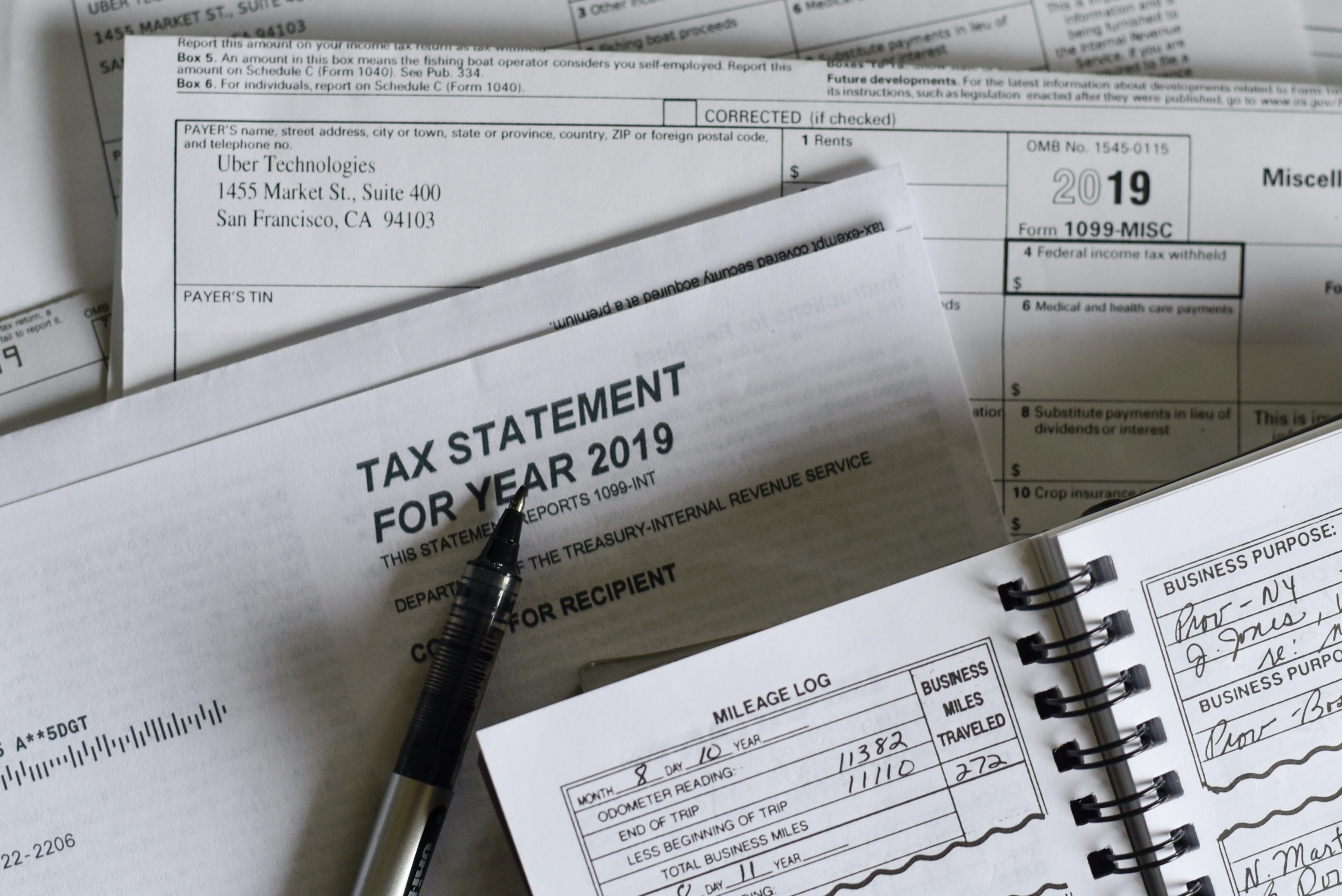

If you work with clients or do work for a gig platform like Uber or Lyft, you may receive a 1099 form from them. If you do, this can help you fill out your income and other tax information. Keep in mind that you’re still responsible for taxes even if you don’t receive a 1099.

If your self-employed income comes from a side hustle, you’ll still have your regular taxes to file from your full-time job. If you work as an employee, you’ll typically receive a W-2 form.

Regardless of what forms you need, you can still file all your taxes at once. You don’t need to prepare separate tax returns for your full-time and side-hustle incomes.

If you’re filing taxes through an online software or service like H&R Block, the system will generally prompt you with questions to determine and provide the forms you need. Otherwise, you can find all the forms on the IRS website.

Once you’ve gathered all the forms that are relevant to you, you simply need to fill them out. For a detailed guide on how to do so, you can find instructions for all types of forms on the IRS website. Or, check out our step-by-step guide to filling out your 1099 tax form.

Confused about your Schedule C form? We have a step-by-step guide for your Schedule C as well.

Once you’ve calculated your self-employment tax, how much you owe and filled out the appropriate forms, paying your taxes is relatively straightforward.

To file taxes as an independent contractor or freelancer, simply send the completed forms to the IRS for filing. The address varies based on:

Either way, double-check the correct filing address for 1040 forms before you ship it off. Keep in mind that these addresses are subject to change from year to year, so always check before sending!

Once you’ve filed, then you have to actually pay whatever you owe, which you can do by either:

If you’re filing your taxes online, you can submit them and pay completely electronically.

If you think you’ll owe more than $1,000 in taxes from your self-employment at the end of the year, you should pay taxes quarterly. Keep reading to find out how to do that.

If you’re new to the self-employed life, quarterly taxes can feel a bit foreign.

But in the US, taxes are a pay-as-you-go system, regardless of your employment. For W-2 employees, taxes are deducted from your paycheck and paid regularly. When you work for yourself, you won’t have taxes automatically withheld, but you do still have to make regular payments, four times per year.

Paying taxes quarterly is called paying your “estimated taxes”.

As a general rule, if you think you’ll owe more than $1,000 in total taxes at the end of the year, or if you make more than $20,000 per year for your self-employed business, you’re supposed to pay quarterly. Otherwise, you may be charged interest on the taxes you were supposed to pay.

The deadlines for paying quarterly are April 15th (your annual taxes count as your first quarterly payment), June 15th, Sept 15th, and Jan 15th.

It’s pretty simple. Just use the IRS's Electronic Federal Tax Payment System (EFTPS) or send your payment by mail.

Still have questions about self employed taxes? The most frequently asked questions we get about self employed taxes are answered below.

This depends on many factors, but as a general rule, we recommend putting aside at least the following percentages, depending on your income level.

You can significantly reduce your taxes by claiming business deductions, like mileage and other business expenses. Everlance can track and help you maximize those deductions.

If your annual net earnings from self-employment are $400 or more, you have to file taxes. Keep in mind that even if your earnings were lower, you still may need to file, so be sure to check no matter what (see the IRS’s Form 1040 for details).

There are two kinds of taxes self-employed workers are responsible for paying: self-employment tax and income tax.

In short, the self-employment tax covers Social Security and Medicare for self-employed individuals.

As a W-2 employee who works full time for a business, your employer pays half of what’s called “FICA tax,” and the rate is 7.65%. Employees also pay 7.65% for FICA taxes on their income (that’s why you’ll have taxes taken out of each paycheck as an employee for Medicare and Social Security).

However, as a self-employed individual, you’re both the employee and the employer, so the bad news is… you’re responsible for both of those tax bills, bringing your self-employment tax rate to 15.3%.

The good news is that this self-employment tax is calculated based on your net income—that is, your income after any eligible business expenses have been deducted. Don’t forget about those tax write-offs! Also, more good news? The 7.65% freelancers pay as the “employer” share of their FICA taxes is an eligible write-off against your income taxes.

Just like employees, self-employed individuals must pay taxes on any income. Your income tax is composed of your federal income tax and your state’s income tax, so it varies from state to state.

The short answer is YES. Regardless of how many streams of income you have, if you’re making more than $400, you owe taxes on it (and possibly even if you make less than that). All of your income needs to be reported on your taxes, even if you work a full-time job and just have a small side hustle.

If you’re filing a W-2 employee, but still have some freelance or side hustle income to claim on your taxes, it’s easy to claim income from your side jobs on your regular taxes. In this case, you’ll want to use the Schedule 1 form to calculate any additional sources of income on top of your W-2 from your regular job.

Keep in mind that you still have to pay the self-employment tax on any income you earned not as a W-2 employee (i.e. income that hasn’t yet been taxed).

Whether you have your own business that’s your primary source of income or just drive for Doordash on the side, you’re considered self-employed and that means you’re eligible to deduct any eligible mileage or business expenses on your taxes.

If you’re still overwhelmed after reading through this guide, we’re here to help.

Making taxes easier (and cheaper) is the name of the game for us. With Everlance, you get automatic mileage tracking so you can track all of your business mileage and deduct it from your taxes.

With the IRS standard rate for mileage sitting at 67 cents per mile, someone who drives only 1,000 miles a year for business has $670 worth of deductions to take!

In addition to tracking mileage, you can also track expenses automatically with Everlance to keep all of your tax deductions and write-offs in one place and make it easy to file and save on taxes. Approaching tax season and haven’t been tracking expenses? No problem, just use our instant deduction finder to find all of your potential business expenses in just a few minutes.

Check out our specific tax guides for Lyft, Wag!, Uber, Doordash or delivery drivers.

More general questions? Check out our Tax Academy.