Driving for Uber means you’re self-employed. That gives you the responsibility of paying your own taxes, but it also gives you access to tax deductions that employees don’t get. Every business-related expense you track can help reduce your taxable income and lower your tax bill.

Here are some of the most common tax deductions that Uber drivers can claim.

Track your miles or vehicle expenses

Your vehicle is your main work tool. You can deduct your driving costs in one of two ways:

Standard mileage method

This is the simplest option. Multiply your business miles by the IRS mileage rate. The rate is designed to include gas, maintenance, depreciation, insurance, and other vehicle costs in one per-mile amount.

Actual expense method

With this method, you track and deduct the actual costs of operating your car for business. This includes:

- Gas

- Repairs

- Oil changes

- Car insurance

- Registration and inspection fees

- Lease payments or depreciation

Tolls and parking can be deducted separately, no matter which method you use.

Deduct your phone and internet use

Your phone is essential for accepting rides, navigating, and communicating with passengers. That means a portion of your phone bill and internet plan may qualify as a deduction. You can also write off:

- Phone mounts, chargers, or hands-free devices used while driving

- A portion of your internet if you use it to manage your Uber account

Write off Uber fees and commissions

Uber charges service fees on every trip. You may also see booking fees or other platform charges. These fees reduce your earnings but are deductible. You can find the totals in your Uber tax summary or trip reports.

Claim business-related supplies

Some small expenses help keep your car clean and your passengers comfortable. Common examples include:

- Car cleaning supplies

- Trash bags or liners

- Air fresheners

- Water bottles or snacks offered to riders

While these items are optional, they are deductible if they help you maintain your rideshare business.

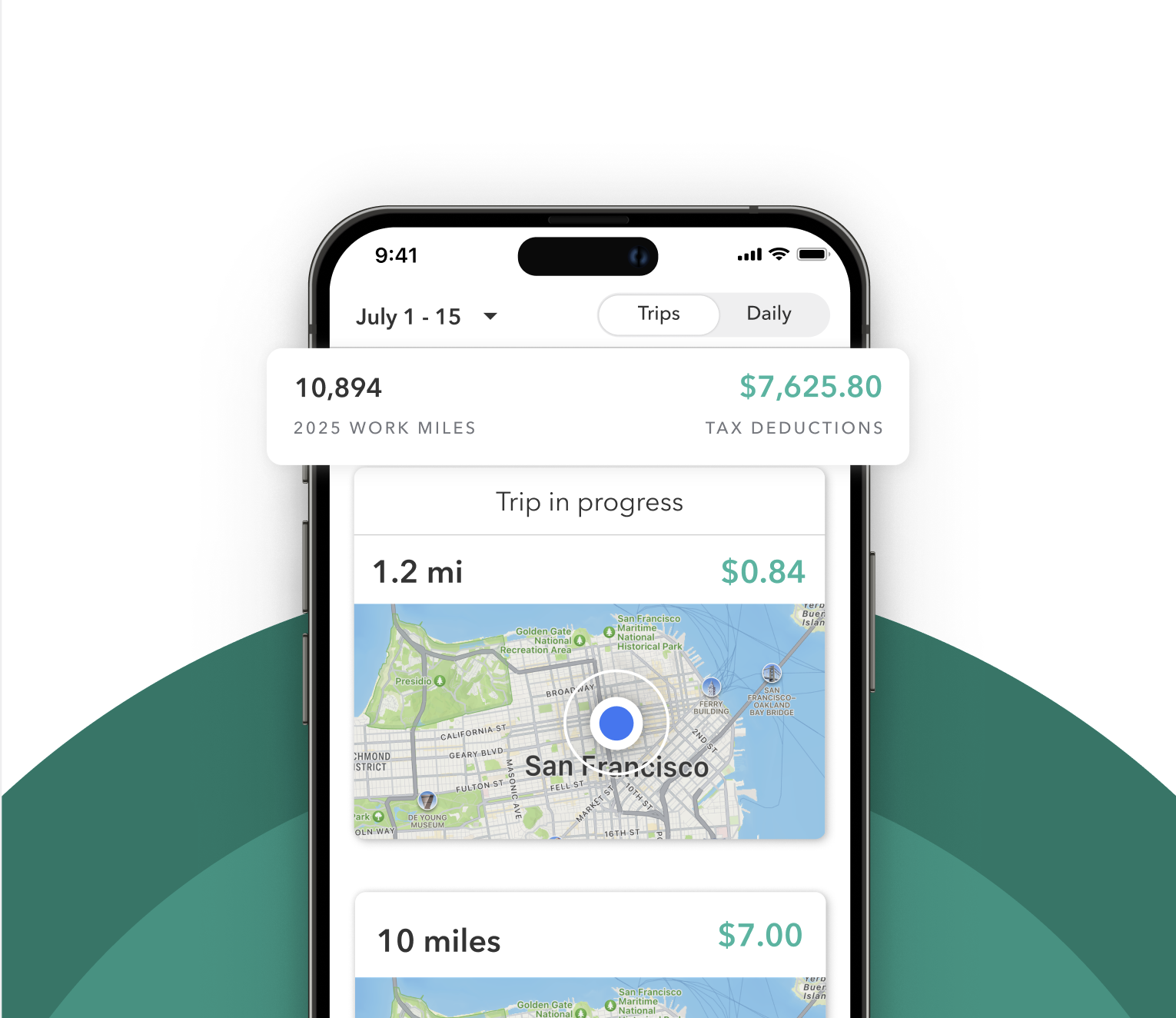

Software and subscriptions

If you pay for apps or services that help manage your driving business, you may be able to deduct them. This can include a mileage tracking app for Uber, tax filing tools, or accounting software. If you also use them for personal purposes, deduct only the business-use portion.

Health insurance premiums

If you pay for your own health insurance, and you’re not eligible for coverage through a spouse, you may be able to deduct your monthly premiums. This deduction can help reduce your overall tax burden even though it’s not tied to your rideshare work directly.

Home office expenses

If you use a specific space in your home to manage your Uber business, such as reviewing earnings, planning routes, or tracking expenses, you may qualify for a home office deduction. The space must be used regularly and only for business.

Education and training

Expenses for courses or certifications that help you become a better rideshare driver or business operator may also be deductible.

Common mistakes Uber drivers make when writing off expenses

- Mixing business and personal costs: Only deduct the portion of expenses tied directly to your driving work.

- Not keeping documentation: You’ll need receipts or records to support your deductions if the IRS asks.

- Overlooking small items: Even $5 items like car wipes or mounts can add up over the year.

- Using the wrong method: Drivers sometimes default to actual expenses when the mileage method would save more. Compare both methods before filing.

Why Uber drivers should track deductions year-round

Successful drivers treat rideshare work like a business. That means keeping records as you go, not just during tax season. Every qualified deduction you track reduces your taxable income and helps you keep more of what you earn.

Uber drivers with organized expense tracking often pay far less in taxes than those who wait until the last minute. By staying on top of your records and knowing which expenses count, you’ll be ready to file with confidence.