Driving for Amazon Flex gives you freedom and flexibility. But it also means you’re self-employed. That changes how you handle your taxes.

You’re now responsible for tracking your income, keeping records, claiming deductions, and paying taxes on your own. And if this is your first time working as an independent contractor, the tax process might feel overwhelming.

This guide walks you through everything you need to know: how taxes work for Amazon Flex drivers, what forms to expect, what expenses you can deduct, and how to stay organized and compliant from day one.

Are Amazon Flex drivers self-employed?

Yes. Amazon Flex classifies drivers as independent contractors, not employees. That means:

- You don’t receive a W-2 form at tax time.

- Amazon does not withhold taxes from your payouts.

- You are responsible for paying both income tax and self-employment tax.

Self-employment tax covers Social Security and Medicare. It’s currently 15.3% of your net earnings (after expenses).

What tax forms will I get from Amazon Flex?

Amazon Flex drivers typically receive a 1099-NEC if they earn $600 or more in a calendar year. In some cases, Amazon may issue a 1099-K instead, depending on how payments were processed. If your earnings fall below IRS thresholds, you might not receive a tax form at all. But your income is still taxable and must be reported.

No matter what Flex tax form you get, you are responsible for reporting your total earnings. You can always access your full income history inside the Amazon Flex driver portal.

What happens if I don’t report my Amazon Flex income?

If you received a 1099, Amazon also sent a copy to the IRS. If your tax return doesn’t include that income, it could trigger a notice, penalties, or an audit. Even if you didn’t receive a 1099, the IRS still expects you to report all your income. Failing to file accurately can lead to fines and interest on top of the taxes owed.

What taxes do Amazon Flex drivers have to pay?

As a self-employed driver, you are responsible for two types of taxes:

Income Tax

This is based on your total taxable income and filing status. It follows the same income tax brackets as anyone else.

Self-Employment Tax

This is a separate tax for independent workers. It covers the Social Security and Medicare taxes that would normally be split with an employer. The current rate is 15.3% of your net earnings.

You may also owe state income tax, depending on where you live.

Do I need to file taxes if I made less than $600 with Amazon Flex?

Yes. The $600 rule only determines whether Amazon must send you a tax form. It does not affect whether you owe taxes. All self-employment income must be reported, no matter how small. If you earned $200 delivering a few packages in December, the IRS still expects you to include it on your tax return.

Do I need to make quarterly estimated tax payments?

If you expect to owe $1,000 or more in taxes for the year, the IRS wants you to make quarterly tax payments throughout the year instead of paying everything in April.

Estimated tax deadlines are:

- April 15

- June 15

- September 15

- January 15 (of the following year)

A good rule of thumb: Set aside 25% to 30% of your self-employment income to cover both income and self-employment taxes.

Can I write off my expenses?

Yes, and you should. You can deduct ordinary and necessary business expenses related to your Amazon Flex business. These write offs reduce your taxable income, therefore reducing the amount of taxes you pay.

Common Amazon Flex driver deductions include:

- Mileage (most popular deduction)

- Tolls and parking

- Phone and data plan (portion used for work)

- Hot bags, phone mounts, chargers

- Car repairs, maintenance, and insurance (if using actual expenses)

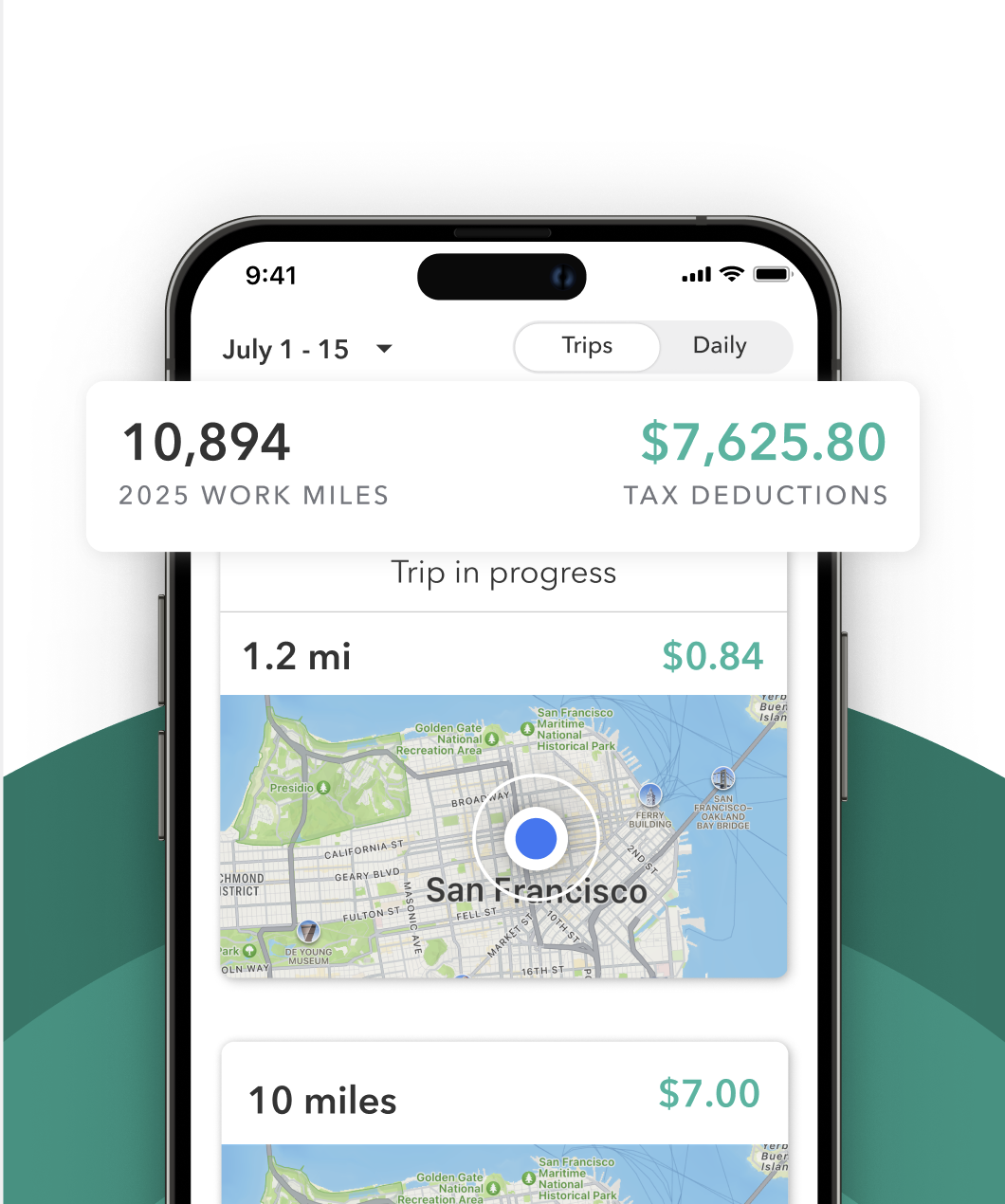

Most drivers use the standard mileage deduction. It’s simpler and often more valuable than tracking every gas receipt and repair. To use the mileage deduction, you’ll need to keep a Amazon Flex mileage log. That means tracking every trip you make for work.

How to file taxes as an Amazon Flex driver

Here’s what you’ll use when it’s time to file:

- Form 1040: Your main personal tax return.

- Schedule C: Reports your self-employment income and expenses.

- Schedule SE: Calculates your self-employment tax.

On Schedule C, you’ll list:

- Your gross income from Amazon Flex (from your 1099 or annual summary)

- Your deductible expenses

- Your net profit (income minus expenses)

This net profit then flows into your 1040 and triggers the calculation of your self-employment tax on Schedule SE.

You can file your taxes manually, use tax software, or work with a tax professional. Many drivers also export mileage and expense reports from tracking apps to simplify this step.

What if I drive for multiple apps?

If you deliver for other platforms like Uber, DoorDash, or Instacart, you still only file one Schedule C.

All self-employment income and expenses go into the same form. Just be careful not to double-count your deductions if you use the same vehicle or phone across platforms. Keeping separate tags or folders for each platform can make this easier.

Common mistakes to avoid

Here are a few things that trip up first-time Flex drivers:

- Not tracking mileage from day one

- Forgetting to deduct business use of your phone

- Thinking income under $600 isn’t taxable

- Mixing personal and business expenses

- Missing quarterly estimated tax payments

- Waiting until April to start organizing receipts

Driving for Amazon Flex gives you independence and earning power, but it also makes you the boss of your own business. That means keeping good records, understanding what you owe, and knowing what you can write off.

It might seem intimidating at first, but once you understand how the system works, filing taxes as a Flex driver gets easier every year. Start early, stay organized, and take advantage of the deductions available to you.