Driving for Shipt means you’re constantly on the move. Whether you’re picking up groceries at Target or delivering last-minute orders to customers, your car is a key part of your business. And all that driving? It could lead to major tax savings.

If you use your own vehicle for Shipt deliveries, you may be eligible to deduct your business mileage on your taxes. This guide explains how mileage deductions work for Shipt shoppers, how to track your miles, and what method might save you the most.

Why tracking your miles matters

As an independent contractor, you’re running your own business. That means you can deduct certain business-related expenses to lower your taxable income. For Shipt shoppers, one of the biggest write-offs is mileage.

Every mile you drive for work can count as a business expense. And those miles add up fast, trips to the store, customer deliveries, and even driving to a shopping location can all qualify. But to deduct your miles, you need a reliable mileage log.

Writing off your Shipt mileage

There are two ways to claim your vehicle costs on your taxes:

- The standard mileage rate method

- The actual expense method

You’ll need to choose one, and the IRS doesn’t let you switch back and forth freely, so it’s important to understand both.

Standard mileage rate method

This is the easiest and most common option for Shipt shoppers. Instead of tracking gas, repairs, and other costs, you just multiply your business miles by the IRS business mileage rate. That rate is designed to cover typical driving expenses like:

- Gas

- Oil changes

- Repairs

- Insurance

- Registration

- Depreciation

But to use this method, you need a detailed mileage log. That means recording every drive related to your Shipt work from the store to the customer’s door.

Actual expense method

This method requires more work, but it could be worth it if you have high vehicle costs. Instead of using a flat rate per mile, you deduct a percentage of your actual car expenses based on how much you use your vehicle for work.

That includes:

- Depreciation

- Lease payments

- Registration fees

- Licenses

- Insurance

- Repairs

- Gas

- Garage rent

- Tires

- Oil

- Tolls

- Parking fees

If 60% of your driving is for Shipt, you can deduct 60% of those expenses.

What the IRS expects

The IRS has strict rules for deducting mileage. If you’re audited and don’t have proper records, your entire deduction could be denied. That means:

- No relying on estimates

- No rounding up miles

- No missing trips

You need a mileage log that includes the date, destination, miles driven, and the business purpose of the trip.

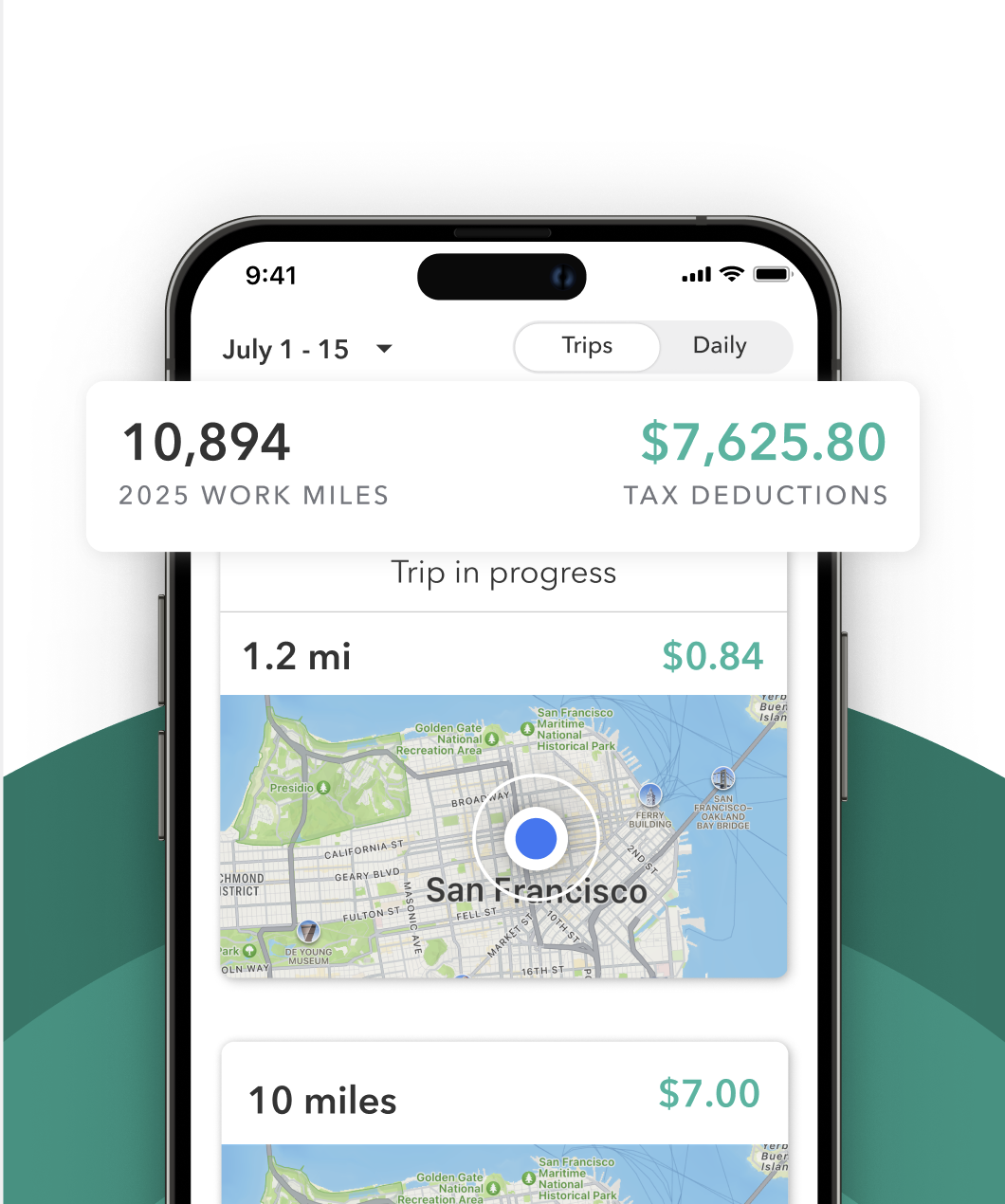

Mileage tracking apps like Everlance make this easy by tracking your trips automatically in the background. You just swipe to classify them as “Work” or “Personal” and export your log at tax time.

Mileage that counts for Shipt

Not sure what trips are deductible? Here’s a quick list of what usually qualifies:

- Driving from your home to a Shipt-approved store

- Travel between multiple delivery stops

- Returning to the store for another batch

- Driving to pick up Shipt delivery supplies

What doesn’t count:

- Personal errands

- Your commute