If you drive with Uber as an independent contractor, tracking your mileage is one of the most important ways to reduce your taxable income. Every qualifying business mile you drive can lower what you owe, saving you hundreds or even thousands of dollars per year. But what actually counts as deductible mileage? How do you keep a compliant log? And how do you choose between the standard mileage rate and actual expenses?

This guide explains how mileage deductions work for Uber drivers, what the IRS allows, how to choose the right method for you, and how to track your miles correctly so you never leave money on the table.

Why mileage tracking matters for Uber drivers

Driving for Uber means using your personal vehicle for business. The IRS recognizes that this involves real costs: fuel, maintenance, depreciation, insurance, and more. To offset those costs, you can deduct business vehicle expenses in one of two ways:

- Standard mileage rate

- Actual expenses method

Most Uber drivers choose the standard mileage rate because it’s simpler, often more lucrative for high-mileage drivers, and requires less paperwork.

Accurate mileage tracking isn’t optional: it’s required by the IRS if you want to claim any vehicle deduction. An incomplete or estimated log could lead to lost deductions or issues if you’re audited. Careful tracking ensures you receive the full deduction you’re entitled to and reduces your taxable income.

What counts as business mileage for Uber

Not every mile you drive is deductible. The IRS requires that deductible mileage be “ordinary and necessary” for your business.

Examples of deductible Uber miles

- Driving to pick up a passenger

- Taking the passenger to their destination

- Traveling between ride requests if you stay available on the app

- Driving to a vehicle inspection required by Uber

- Going to pick up supplies or equipment for your rideshare work

What is not deductible

- Your commute from home to your first pick-up if you’re offline

- Driving home after logging out at the end of your shift (unless your home qualifies as your principal place of business)

- Personal errands, even if they occur during your workday

It’s important to keep clear records separating business and personal use. Blending them can create problems if the IRS reviews your return.

Standard mileage rate

The standard IRS mileage rate is the most popular way for Uber drivers to claim vehicle expenses.

What it is

A single, IRS-set per-mile rate designed to cover all vehicle-related costs, including gas, oil, maintenance, insurance, depreciation, and more. You multiply your total business miles for the year by the IRS mileage rate for that year. The standard rate is popular among Uber drivers because it’s straightforward and usually favorable for those who put a lot of miles on their car.

Actual expenses method

The other option is to deduct the actual costs of operating your vehicle for Uber. You track all of your vehicle costs for the year, calculating what % of them are for business use throughout, or taking the % of business miles at the end of the year, and then deduct that business-use percentage of your total expenses. For example, if you drove 20,000 miles total in a year, with 15,000 miles for Uber, that’s 75 percent business use. You can deduct 75 percent of your qualifying vehicle expenses.

What it includes

- Gas and oil

- Repairs and maintenance

- Insurance premiums

- Lease payments or vehicle depreciation

- Registration fees

Expenses you can deduct regardless of method

No matter which method you use, you can also deduct certain costs separately.

Examples include:

- Tolls paid while driving for Uber

- Parking fees you incur while waiting for or picking up passengers (but not traffic tickets or fines)

These expenses are deductible even if you choose the standard mileage rate.

For more on how the IRS looks at vehicle expenses, check out IRS topic 510, business use of car.

How to track your Uber mileage

If you want to claim vehicle expenses, the IRS requires a detailed, contemporaneous mileage log. You cannot simply estimate or guess your miles at tax time. Your log must include:

- The date of each trip

- Starting location and destination

- Business purpose (for example, “Picked up Uber passenger”)

- Total miles driven for the trip

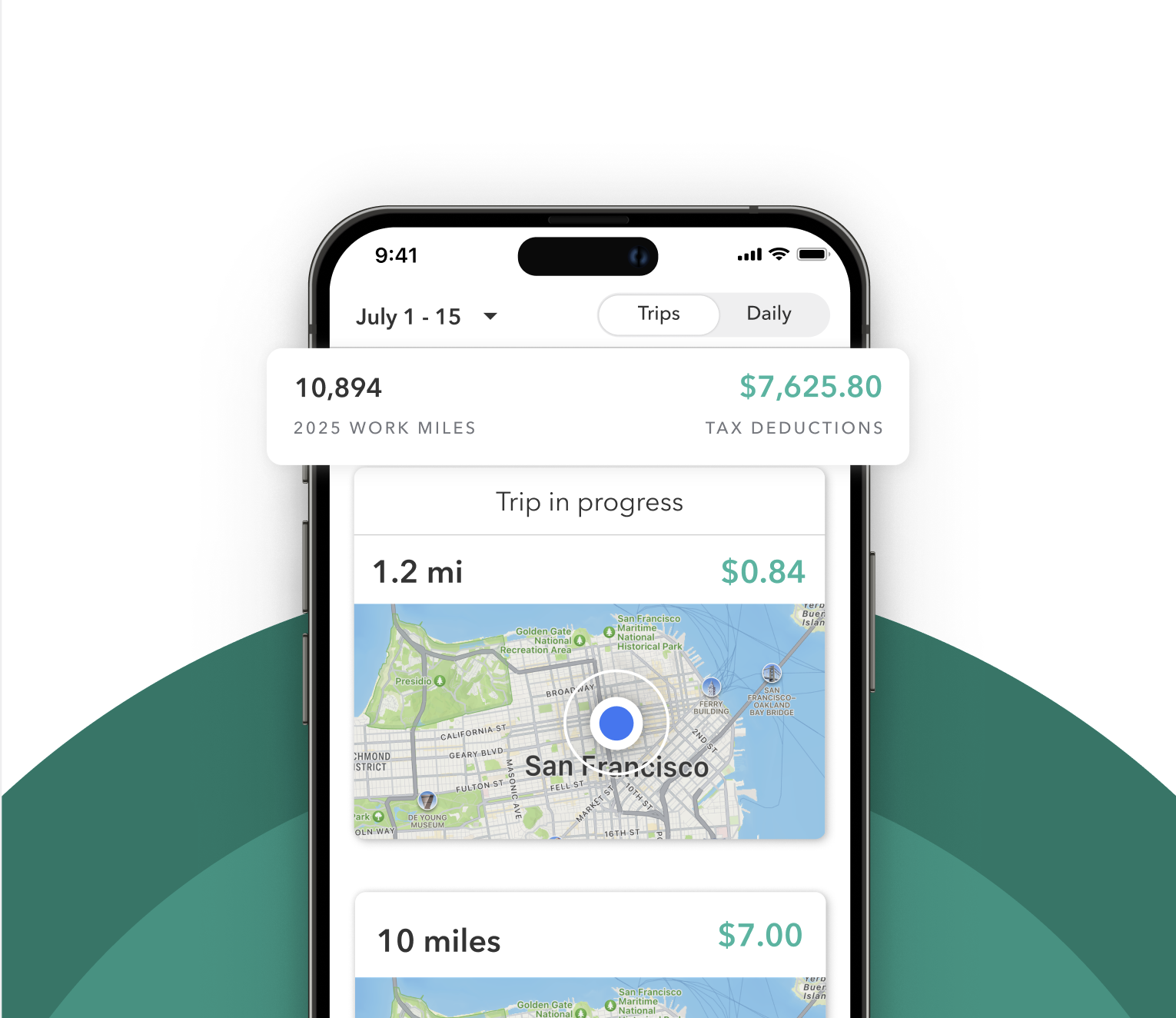

You can do this manually in a notebook or spreadsheet, but this approach is prone to errors and easy to forget on busy days. Missing trips can cost you real money in lost deductions. Many rideshare drivers use mileage-tracking apps for simplicity and accuracy. Tools like Everlance automatically detect trips in the background and let you classify them as business or personal with a swipe. At tax time, you can export an IRS-compliant log in seconds.

Apps help you avoid missed trips, reduce errors, and create bulletproof records if you’re ever audited.

How to claim your mileage deduction

When tax time comes, you’ll report your driving expenses on Schedule C (Form 1040) as a self-employed driver. You’ll choose one of two methods:

- Standard mileage rate: Multiply your business miles by the IRS mileage rate for the year.

- Actual expenses: Deduct the business-use percentage of your real vehicle costs.

You cannot use both methods for the same vehicle in the same year. Once you choose a method, you need to stick with it unless you meet specific IRS requirements to switch. No matter which method you use, you must keep all your supporting mileage logs and receipts for at least three years in case of an IRS audit.

If you’re not sure which method is better for your situation, consider talking to a tax professional who understands gig work and can help you maximize your deductions.

Common mistakes Uber drivers make

Many rideshare drivers accidentally reduce their deductions or risk IRS trouble by making these avoidable errors:

- Forgetting to track miles consistently: Sporadic tracking leads to lost deductions and incomplete records.

- Including personal trips: You must carefully separate business and personal mileage.

- Switching methods mid-year without following IRS rules: Changing from standard mileage to actual expenses (or vice versa) requires specific IRS criteria.

- Estimating miles: Rounded guesses are not acceptable. The IRS expects a detailed log.

Mileage is one of the biggest deductions available to Uber drivers. By keeping an accurate, IRS-compliant log and choosing the right method, you can significantly reduce your taxable income and keep more of your earnings.