If you’re delivering for Walmart Spark, you’re earning income as an independent contractor. That means you’re technically running your own business, even if you only drive part time. It also means your taxes will look different than they do for a regular day job. You won’t have taxes taken out of your pay, and you’ll need to handle things like deductions, self-employment tax, and possibly quarterly payments.

Don’t worry, though. We’ll walk you through what you need to know to stay on the IRS’s good side and keep more of what you earn.

Are Walmart Spark drivers self-employed?

Yes. Spark drivers are independent contractors, not employees. Because of that, you handle your own taxes.

Two kinds of taxes apply:

- Income tax: Based on your total taxable income from all sources.

- Self-employment tax: 15.3% of your net profit. This covers Social Security and Medicare. Employees split these taxes with an employer. When you are self-employed, you pay both parts.

You must file a tax return if you earn at least $400 in net self-employment income during the year. Even if you earn less, it is smart to track everything so you are ready when your income grows.

What income Spark drivers need to report to the IRS

All of your Walmart Spark pay counts as taxable income. That includes:

- Delivery pay

- Tips

- Bonuses or surge incentives

- Referral or sign-up rewards

It does not matter whether Spark sends you a tax form. If the money hit your account, the IRS expects it to be reported. This also applies if Spark was a side gig and you have a W-2 job. You will report both on the same return.

Know the difference between gross income and net income. Gross is the total you earned. Net is what’s left after subtracting business expenses. Your taxes are based on that net number, so tracking expenses matters.

What 1099 tax forms Spark drivers receive

By January 31, Walmart Spark (or its payment partner, such as Branch) may issue one or more 1099 forms depending on how you were paid.

- 1099-K: Used when earnings are processed through certain third-party payment networks.

- 1099-NEC: Used for direct payments for your services.

You can download these in the Spark driver app or the payment portal you use. Review them and compare against your own records. Forms show what Spark reported to the IRS, but they do not show your deductible expenses.

Important: You must report all Spark income even if you did not receive a 1099. The $600 threshold is only about whether Spark must send a form. It does not erase your tax responsibility.

How to file Walmart Spark taxes and make quarterly payments

When it is time to file your return, you will complete:

- Schedule C (Form 1040) to report your Spark income and deductible expenses.

- Schedule SE to calculate your self-employment tax.

If you also work for other gig apps (DoorDash, UberEats, Instacart, etc.), combine all of your self-employment income and expenses on the same Schedule C.

Estimated quarterly tax payments

Because Spark does not withhold taxes, many drivers need to make estimated tax payments during the year. The IRS expects these if you will owe at least $1,000 in tax when you file.

Quarterly due dates:

- April 15

- June 15

- September 15

- January 15 (of the following year)

You can pay online at the IRS website, through EFTPS, or using tax software built for self-employed workers. A simple habit: set aside money from every Spark payout so the quarterly amounts are ready when due.

Not sure if you need to pay quarterly? If Spark is a meaningful slice of your income, assume yes and run an estimate. Better to pay in and get a refund than owe penalties.

Tax deductions for Walmart Spark drivers

Deductions are where Spark drivers can save real money. Deductions lower your net profit, which lowers both income tax and self-employment tax.

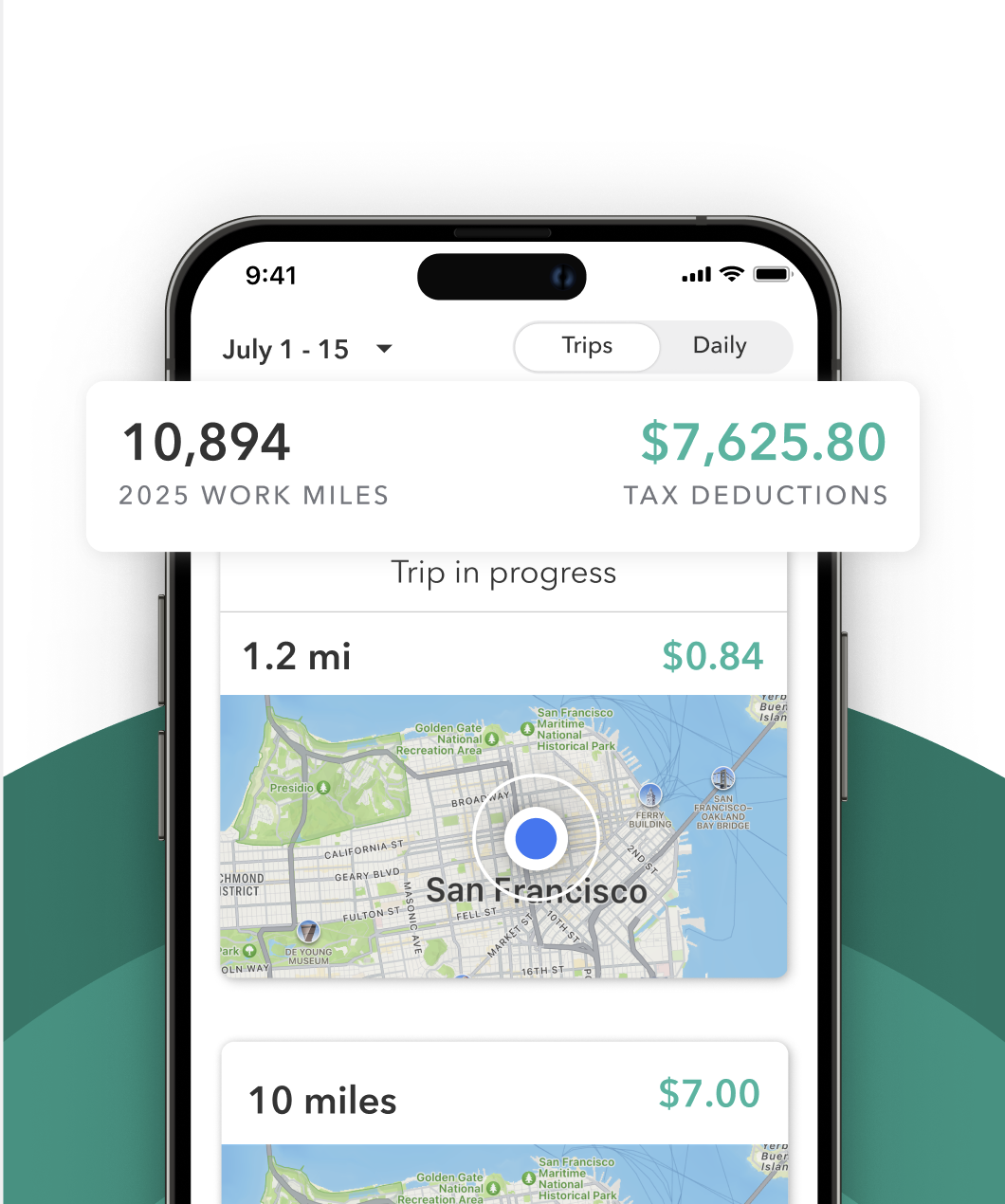

The biggest deduction for most drivers is business mileage. For 2025, the IRS standard mileage rate is 70 cents per business mile. That covers gas, maintenance, insurance, and wear on your vehicle in one simple rate.

Miles that usually count:

- Driving to the Walmart store to pick up an order

- Driving from the store to the customer

- Driving between Spark deliveries while you are working

If you use the standard mileage method, you cannot also deduct actual car costs like gas or repairs separately. The rate already includes those.

Prefer to deduct your real vehicle costs? You can choose the actual expense method instead. You will track and prorate costs such as fuel, insurance, repairs, tires, registration, and depreciation based on business use.

Other possible Spark tax deductions:

- Portion of your phone and data plan used for Spark driving

- Delivery gear (hot bags, phone mounts, chargers)

- Parking fees and tolls paid while completing Spark deliveries

To claim deductions, you need records. The IRS wants a mileage log that shows date, purpose, and miles. Apps like Everlance track your trips automatically and store receipts so you are audit-ready without extra work.

Common tax mistakes Spark drivers should avoid

Missing mileage. Skipping mileage tracking is the number one way drivers lose money at tax time. Even a few thousand business miles can equal a large deduction.

Not saving for taxes. Spark deposits feel great until tax season. Set aside part of every payout so you are not scrambling.

Mixing personal and business. If you claim actual car expenses or partial phone costs, keep notes or use separate accounts so you can show what was for Spark.

Skipping estimated payments. If you owe enough and do not pay quarterly, the IRS may charge penalties.

Reporting only what’s on the 1099. Compare the form to your own records. Report all Spark income, even amounts under reporting thresholds