Shipt is a grocery delivery platform that pays you to shop for and deliver items to customers. As a Shipt Shopper or Driver, you work on your own schedule, get paid per order, and have the chance to earn tips. But how much can you really make?

This guide breaks down how Shipt pay works, what factors affect your income, and tips to help you earn more.

How Shipt Pay Works

Shipt Shoppers are independent contractors. You earn money for each order you accept and complete, and you keep 100% of your tips. Your total payout is based on several factors:

- Estimated time to shop and deliver

- Size and complexity of the order

- Distance to the customer

- Peak time bonuses or promos

Each order offer includes an estimated payout. You can see this before accepting the order in the Shipt app.

Average Shipt Shopper Earnings

Most Shipt Shoppers report earning between $16 to $22 per hour, with top performers in busy areas making $25 or more per hour. Your actual earnings depend on how efficiently you shop, how busy your area is, and how many orders you complete.

Your earnings will depend on:

- Order volume and customer demand

- Time of day and day of the week

- Number of orders you accept per shift

- Distance driven and gas expenses

- How often customers tip and how much

Do Shipt Shoppers Get Tips?

Yes. Customers can tip in the app or in person, and Shoppers keep 100% of the tips. Tips are a significant part of your income. Many experienced Shoppers say tips can account for 30% or more of their total pay.

To increase your chances of getting tipped:

- Be friendly and communicative

- Shop accurately and avoid missing items

- Send updates if items are out of stock

- Deliver orders on time and neatly

Bonuses and Incentives

Shipt often runs bonus programs to reward top shoppers. These may include:

- Extra pay for completing a certain number of orders in a time frame

- Peak-time boosts in high-demand areas

- Referral bonuses for inviting friends to become Shoppers

You can view available incentives in the app and plan your schedule to take advantage of them.

How to Maximize Your Shipt Earnings

To make more money with Shipt, focus on efficiency and strategy:

Work High-Demand Hours

Most customers place orders in the late morning, early afternoon, and early evening. Weekends tend to be the busiest. Shop when demand is highest to maximize order volume and tips.

Pick the Best Orders

Review order details before accepting. Large or complex orders with low payouts may not be worth the time. Look for offers with good base pay and short delivery distances. However, don’t be too picky, as Shipt values acceptance and completion percentages

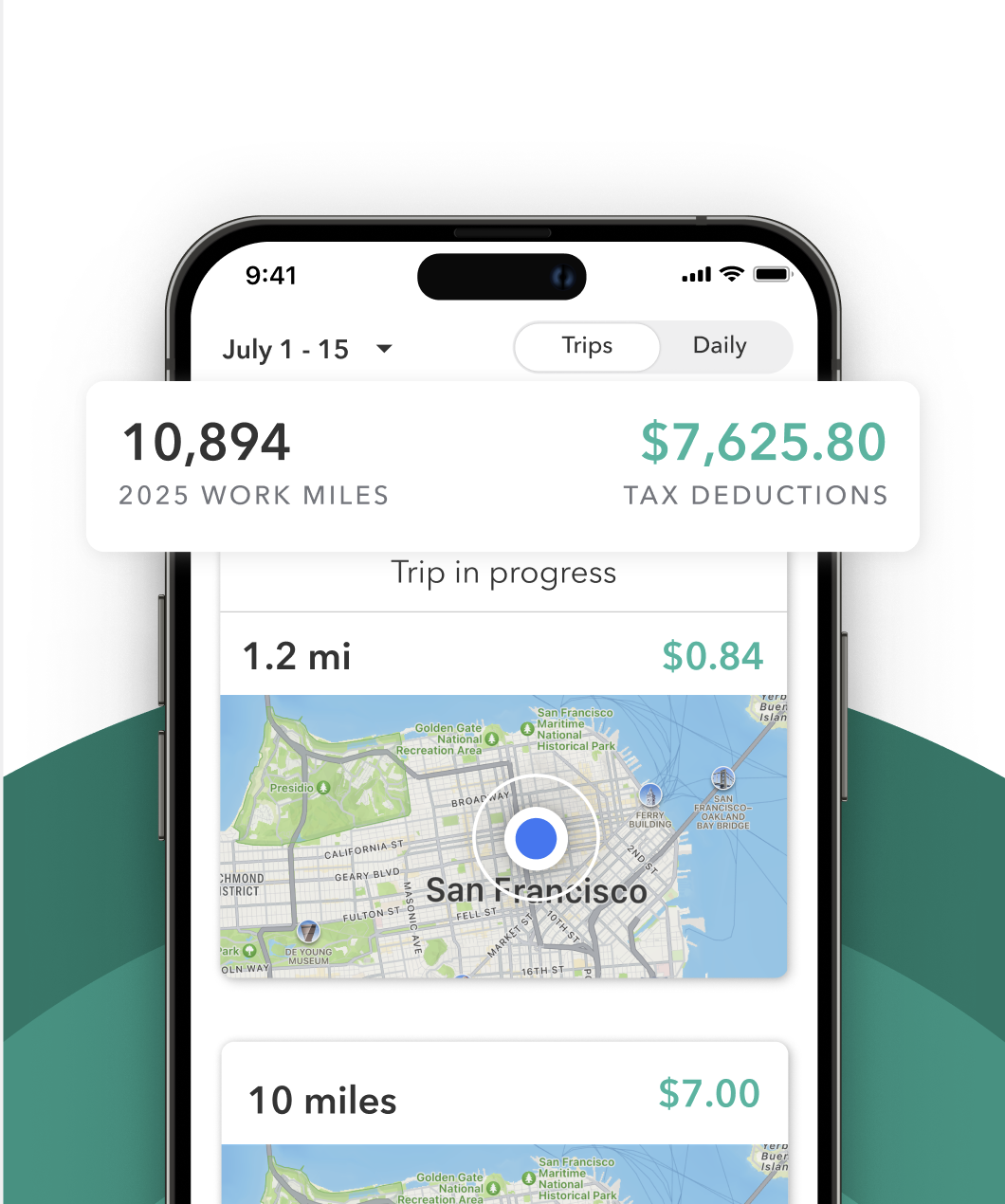

Track Your Expenses for Taxes

As an independent contractor, you are responsible for your own taxes. The good news is that Shipt mileage and business expenses are deductible. Use Everlance to automatically track your mileage and save money at tax time.

Reduce Expenses

Save money by planning efficient routes, maintaining your car regularly, and bundling nearby deliveries when possible. The less you spend, the more of your earnings you keep.

Real Shopper Insights

Many Shipt Shoppers enjoy the freedom to choose when and how much they work. Whether you’re doing it part-time or as a full-time gig, success comes down to strategy. Efficient shopping, great customer service, and consistent tracking of your expenses are the keys to making the most of your time on the road.

If you enjoy shopping, staying organized, and helping others, Shipt can be a reliable way to earn income on your own schedule.