Delivering for Shipt gives you the freedom to work on your own terms, but it also means you’re self-employed. That comes with added responsibility when it comes to taxes. Shipt shoppers are classified as independent contractors, which means you’re in charge of reporting your income, keeping records, and claiming deductions. This guide covers everything you need to know to stay compliant and maximize your earnings.

Are Shipt shoppers & drivers self-employed?

Yes. If you deliver for Shipt, you are considered a self-employed independent contractor. You won’t receive a W2, and Shipt does not withhold taxes from your pay. You are responsible for paying both federal and state income taxes, as well as self-employment tax, which covers Social Security and Medicare. The self-employment tax rate is 15.3%.

What tax forms do you get from Shipt?

If you earn $600 or more in a calendar year, Shipt will issue a 1099 tax form. You can access your 1099 in the Shipt portal during tax season. If you earned less than $600, you might not receive a 1099 form, but your income is still taxable and must be reported to the IRS.

What happens if I don’t report my Shipt earnings

Shipt sends copies of 1099s to the IRS. If you fail to report income, you may be subject to penalties, interest, or even an audit. Even if no form was issued, the IRS expects you to report all self-employment income. Accurate recordkeeping and timely filing are essential.

How to file taxes as a Shipt shopper or driver

To file taxes, you’ll use IRS Form 1040 with Schedule C to report your income and deductions, and Schedule SE for self-employment tax. You can use tax software, hire a tax pro, or file directly through Everlance if you’re already using it to track your expenses and mileage.

Do I have to file taxes if I made less than $600?

Yes. The IRS requires you to report all self-employment income, even if you don’t receive a 1099. The $600 threshold only determines whether Shipt is required to send you a tax form. If you earned income while shopping or delivering, you must include it in your tax return.

Do I need to pay quarterly taxes?

If you expect to owe $1,000 or more in taxes this year, the IRS requires quarterly estimated tax payments. These are due in April, June, September, and January. Many shoppers set aside 25% to 30% of their income for taxes. A tax calculator or software can help estimate your payments.

What if I work for multiple apps?

If you also drive for Instacart, UberEats, or DoorDash, you’ll combine all of your income and expenses into one Schedule C. Business costs like mileage and phone use can be shared across platforms, as long as you avoid double-counting. A gig tracking app like Everlance can help keep everything organized.

What expenses can Shipt shopper & drivers deduct?

As an independent contractor, you can deduct qualified business expenses to reduce your taxable income. Common Shipt deductions include:

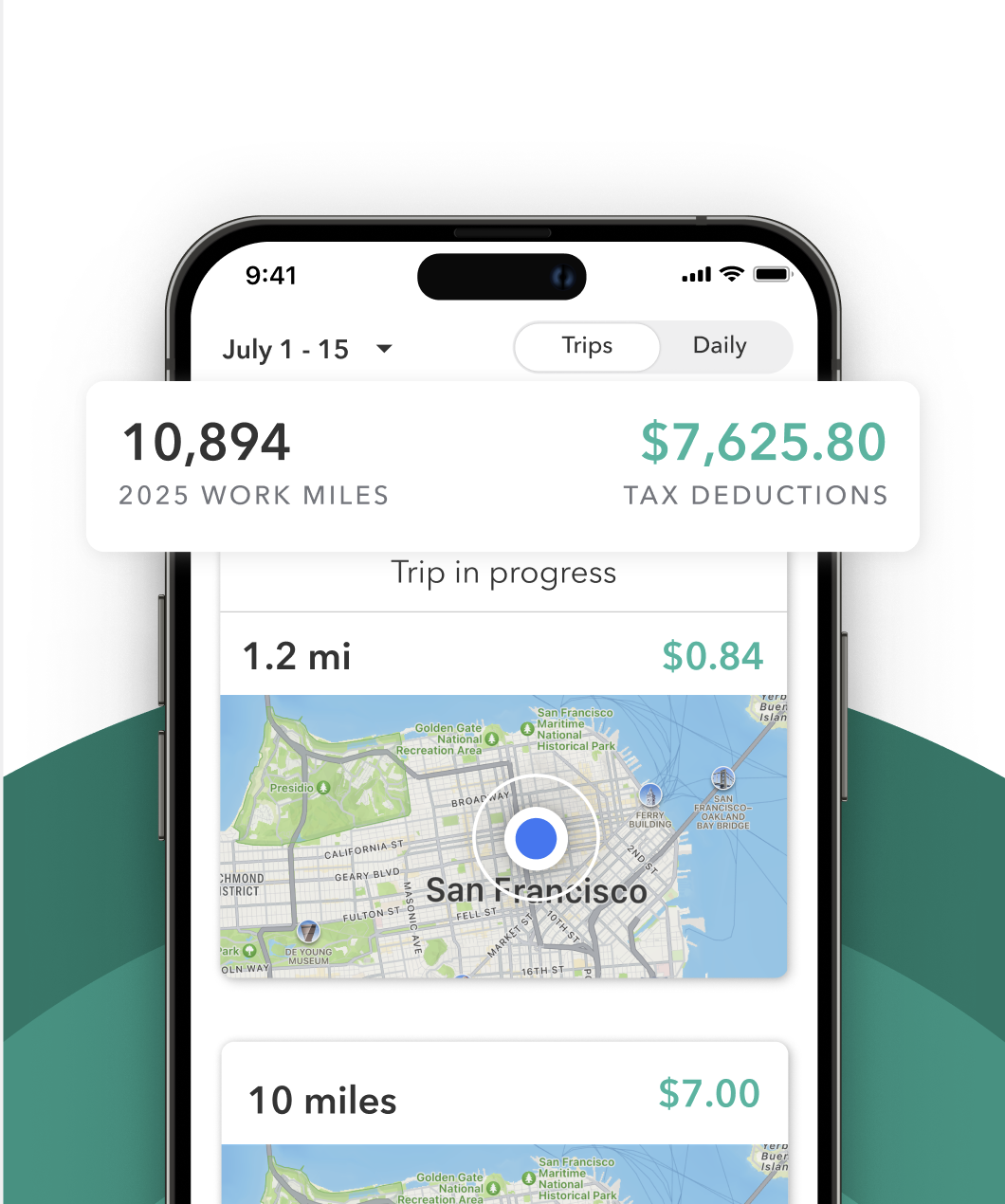

- Shipt mileage driven for deliveries and in between orders

- A portion of your phone and data bill

- Parking fees and tolls

- Delivery supplies and gear

- Car expenses if using the actual expense method (Most Shipt shoppers use the IRS mileage rate. To claim it, you’ll need to keep accurate mileage logs for your business driving.)

Common mistakes to avoid

Everlance was started in 2015, so we've seen a lot when it comes to independent work. Some of the most common mistakes we see among Shipt shoppers & drivers are:

- Not tracking delivery mileage

- Believing that earnings under $600 don’t need to be reported

- Missing estimated tax payments

- Forgetting about deductions for supplies or phone use

- Relying only on Shipt’s summary

- Mixing business and personal expenses

Make tax time easier by staying organized year-round

Like we mentioned earlier, delivering for Shipt means you’re running a business, even if it’s just a side hustle. That might feel overwhelming at first, but it also gives you the chance to take control of your finances and keep more of what you earn. The key is consistency. Track your mileage, save your receipts, and set aside a portion of each payout for taxes. Tools like Everlance can help you automate those tasks, so you’re not scrambling at tax time or leaving deductions on the table.

Being prepared now means fewer surprises later.